Bending the Third Rail

Because We Should, We Can, We Do

Cost of the War in Iraq

(JavaScript Error)

Friday, March 02, 2007

Saudi Oil

The Oil Drum is publishing a post by Stuart Staniford on oil production in Saudi Arabia. It's a good read with lots of information.

The main thing I got out of it was this:

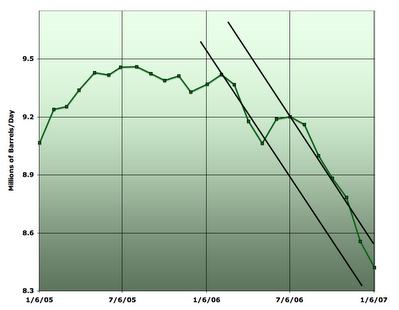

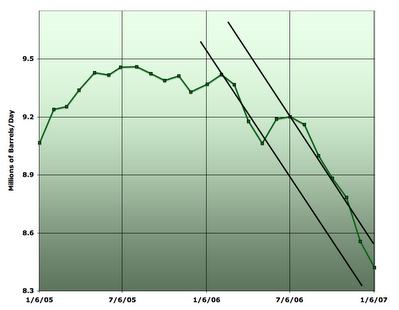

The conclusion Staniford reached based on all the information gathered, including the above chart was this:

The conclusion Staniford reached based on all the information gathered, including the above chart was this:

If true, the economic, social, and political implications are enormous. This is not the first story we've heard of major producers having reduced output (see Mexico) while new finds are not keeping up with demand.

File this under another tick in the direction of peak oil happening. Time to buy more oil futures? As a side note, during the current stock market "correction", the one safe haven has been oil futures which actually rose a bit the other day. What do you think the market is saying about peak oil? Is oil the new gold?

The main thing I got out of it was this:

The conclusion Staniford reached based on all the information gathered, including the above chart was this:

The conclusion Staniford reached based on all the information gathered, including the above chart was this:* Saudi Arabian oil production is now in decline.There could be many reasons for a production decline such as seen in 2006. But you'd think with prices being as high as they were, production wouldn't have fallen so precipitously? Staniford goes thorugh the data including a reasonable explanation for the brief uptick in production during the summer. He further offers to bet anyone that Saudi Arabia's production will never reach 10 million barrels per day.

* The decline rate during the first year is very high (8%), akin to decline rates in other places developed with modern horizontal drilling techniques such as the North Sea.

* Declines are rather unlikely to be arrested, and may well accelerate.

* Matt Simmons appears to be right in Twilight in the Desert, but the warning did not come until after declines had actually begun.

If true, the economic, social, and political implications are enormous. This is not the first story we've heard of major producers having reduced output (see Mexico) while new finds are not keeping up with demand.

File this under another tick in the direction of peak oil happening. Time to buy more oil futures? As a side note, during the current stock market "correction", the one safe haven has been oil futures which actually rose a bit the other day. What do you think the market is saying about peak oil? Is oil the new gold?

0 Comments:

About Me

- Name: Greyhair

- Location: Wine Country, California

I'm a very lucky person with every allergy known to man but still happy to be enjoying a wonderful life living in the best place in the world!

Blogroll

The Big PictureBillmon

Blah3.com

Born at the Crest of Empire

Eric Alterman

Eschaton

FireDogLake

Feingold's Blog

Dan Froomkin

The Huffington Post

Hullabaloo

The Illustrated Daily Scribble

Jesus General

Juan Cole

Matilda's Advice and Rants

Mia Culpa

MsJan Quilts

Needlenose

The Oil Drum

Political Animal

Political Wire

Spooks of the Ozarks

Talk About Corruption

TalkLeft

Think Progress

War and Peace

The Washington Note