Bending the Third Rail

Because We Should, We Can, We Do

Cost of the War in Iraq

(JavaScript Error)

Thursday, October 05, 2006

More Stock Stuff

Barry Ritholtz, my favorite bear/realist, has a nice post up today (like most days) about the new "record" DOW:

Barry Ritholtz, my favorite bear/realist, has a nice post up today (like most days) about the new "record" DOW:Reviewing yesterday's market internals, we did see breadth improve significantly; volume also was better than it has been. Marketbeat ticked off what the usual suspects are that must be overcome for this to be sustainable: "the yield curve is still inverted, the Dow Transports haven't "confirmed" the move, the Russell 2000 has diverged from the Dow, many indices are showing a "double-top" -- and of course, the old standby, that the Dow doesn't matter anyway."The items italicized above are typical of a stock market that is really really moving up, rather than a head fake.

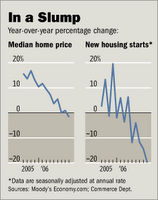

There seems to be a growing concensus that the economy is slowing. At this point the bet is this: is the market going into a moderating/leveling period (the so-called Goldilocks economy) or a recession or worse? Those who are investing are betting on a good economy going forward. I also would like to see how much of the money dumping into the market is retail money vs. the pros.

In short, I'm skeptical.

My skepticism comes specifically from a number of datapoints that I've posted before. More abstractly, it comes from the idea that a corrupt-right-leaning-corporate-focused-government-driven economy (watch out, watch out, here it comes, the "F" word, Fascists government!) must implode eventually. All of the artificial mechanism, i.e. tax cuts, artificially low interest rates, hemorraging spending on a foreign war, and massive debt cannot sustain a healthy economy forever. The chickens have to come home to roost eventually and you gotta wonder if it's on the horizon in the form of a serious recession (at best). I certainly hope not. But when the numbskulls in power are celebrating, I'm nervous.

0 Comments:

About Me

- Name: Greyhair

- Location: Wine Country, California

I'm a very lucky person with every allergy known to man but still happy to be enjoying a wonderful life living in the best place in the world!

Blogroll

The Big PictureBillmon

Blah3.com

Born at the Crest of Empire

Eric Alterman

Eschaton

FireDogLake

Feingold's Blog

Dan Froomkin

The Huffington Post

Hullabaloo

The Illustrated Daily Scribble

Jesus General

Juan Cole

Matilda's Advice and Rants

Mia Culpa

MsJan Quilts

Needlenose

The Oil Drum

Political Animal

Political Wire

Spooks of the Ozarks

Talk About Corruption

TalkLeft

Think Progress

War and Peace

The Washington Note