Bending the Third Rail

Because We Should, We Can, We Do

Cost of the War in Iraq

(JavaScript Error)

Wednesday, March 14, 2007

That's Weird

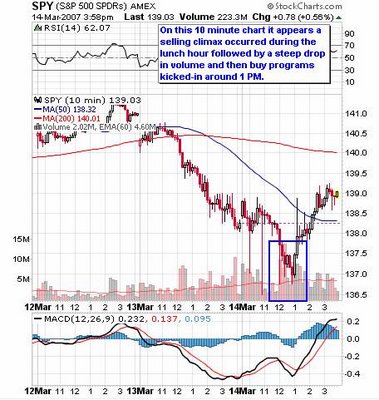

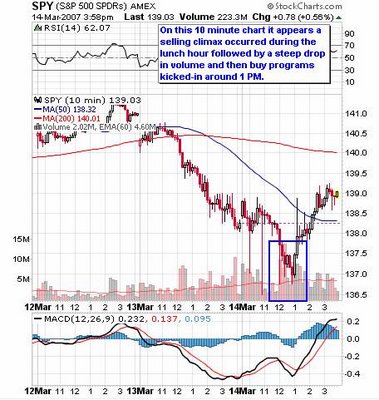

The stock market behaved very unusually today. It was apparently heading for another serious drop when it suddenly reversed. The trading volume (a confirming indication of a falling market) on the downside was very high. When it began to rise, it did so on quite a bit less volume. This is a chart of every 10 minutes of today's market activity. The box is drawn around the period when the bottom hit, and volume (the shaded bars on the graph bottom) began to fall off:

So what's up?

Conventional wisdom is that it was a "retest" of the correction lows, and the fact that "it bounced" off the lows suggests that the lows have been successfully tested and the market can now head for the moon!

Here's the reality:

This kind of market manipulation is not uncommon. But it certainly illustrates a couple of important points. First, the markets are not all the open public squares that conservatives would like you to think. Rather, there's Big Ben and Unkie Paulson sitting on the sidelines ready to send in the calvary with wagon loads of newly printed dough if the market needs propping up. And it's is a form of corporate welfare that is paid for by taxpayers. Second and likely more importantly, it's inflationary. It's just these kind of actions to "increase market liquidity" that keep cash sloshing around in the system and fuel bubbles, causing rising prices in the marketplace. These are also practices that I suspect are much more common when we have a government that is trying to have guns and butter. And it's how you can end up with stagflation .... low growth and rising prices.

So what's up?

Conventional wisdom is that it was a "retest" of the correction lows, and the fact that "it bounced" off the lows suggests that the lows have been successfully tested and the market can now head for the moon!

Here's the reality:

The following graphic outlines Treasury lending activity. As you can see it has been pretty quiet there for over a month. Today however, they tossed in some serious money to their primary dealer network as the markets were declining today. I’ll admit not knowing “when” this action was done but I did look about an hour after the market opened and didn’t note any activity. In any event, a rally followed. Coincidence? Well, B still follows A in my book.It would also seem that the Federal Reserve (the Fed) dumped a bunch of money into the system at about the same time.

Let’s see that would make $27.75 billion to the primary dealers in one day from both the Fed and the Treasury. Money talks folks.So the big money boys came to the market rescue!

This kind of market manipulation is not uncommon. But it certainly illustrates a couple of important points. First, the markets are not all the open public squares that conservatives would like you to think. Rather, there's Big Ben and Unkie Paulson sitting on the sidelines ready to send in the calvary with wagon loads of newly printed dough if the market needs propping up. And it's is a form of corporate welfare that is paid for by taxpayers. Second and likely more importantly, it's inflationary. It's just these kind of actions to "increase market liquidity" that keep cash sloshing around in the system and fuel bubbles, causing rising prices in the marketplace. These are also practices that I suspect are much more common when we have a government that is trying to have guns and butter. And it's how you can end up with stagflation .... low growth and rising prices.

0 Comments:

About Me

- Name: Greyhair

- Location: Wine Country, California

I'm a very lucky person with every allergy known to man but still happy to be enjoying a wonderful life living in the best place in the world!

Blogroll

The Big PictureBillmon

Blah3.com

Born at the Crest of Empire

Eric Alterman

Eschaton

FireDogLake

Feingold's Blog

Dan Froomkin

The Huffington Post

Hullabaloo

The Illustrated Daily Scribble

Jesus General

Juan Cole

Matilda's Advice and Rants

Mia Culpa

MsJan Quilts

Needlenose

The Oil Drum

Political Animal

Political Wire

Spooks of the Ozarks

Talk About Corruption

TalkLeft

Think Progress

War and Peace

The Washington Note