Bending the Third Rail

Because We Should, We Can, We Do

Cost of the War in Iraq

(JavaScript Error)

Friday, February 09, 2007

Sub-Prime Meltdown

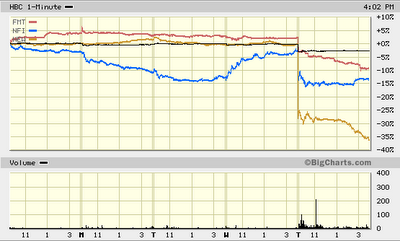

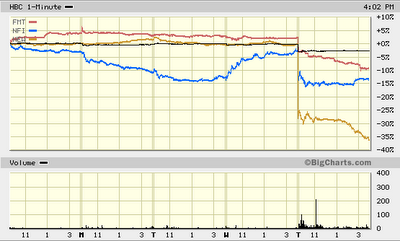

As most of you know, the recent bubble in the housing market was created in part by cheap money and eased lending practices. One of the consequences of the unraveling of a housing bubble can be when the chickens come home to rooast. As variable interest rates climb, many borrowers (who thought rates would stay low forever) are having serious problems and defaults are on the rise. Yesterday saw headline news on this when one subprime lender announced problems with their loan portfolio. The stocks in a number of lenders responded accordingly:

That's quite a haircut. Analyst opinions on the issue range from "one lenders problems are not all lenders problems" to "if rates go much higher, we may see a meltdown". The stock market in general continues to behave as if there is zero risk in the world (likely another bubble), so who knows what will happen, particularly in the long run .....

That's quite a haircut. Analyst opinions on the issue range from "one lenders problems are not all lenders problems" to "if rates go much higher, we may see a meltdown". The stock market in general continues to behave as if there is zero risk in the world (likely another bubble), so who knows what will happen, particularly in the long run .....

1 Comments:

About Me

- Name: Greyhair

- Location: Wine Country, California

I'm a very lucky person with every allergy known to man but still happy to be enjoying a wonderful life living in the best place in the world!

Blogroll

The Big PictureBillmon

Blah3.com

Born at the Crest of Empire

Eric Alterman

Eschaton

FireDogLake

Feingold's Blog

Dan Froomkin

The Huffington Post

Hullabaloo

The Illustrated Daily Scribble

Jesus General

Juan Cole

Matilda's Advice and Rants

Mia Culpa

MsJan Quilts

Needlenose

The Oil Drum

Political Animal

Political Wire

Spooks of the Ozarks

Talk About Corruption

TalkLeft

Think Progress

War and Peace

The Washington Note

That's because they are stupid. Had they paid attention to the world around them they would have been forwarned. No sympathy here.