Bending the Third Rail

Because We Should, We Can, We Do

Cost of the War in Iraq

(JavaScript Error)

Tuesday, December 05, 2006

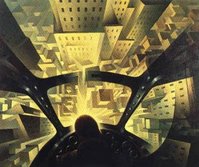

Dollarship Down

The dollar has been taking a nose-dive lately.

The dollar has been taking a nose-dive lately.Why does that matter to you? Because when dollars, the world currency, goes down against other currencies international exporters have to raise their prices to get the same value. It also makes exports from the U.S. cheaper, which is a good thing. But since we import so many goods these days, prices will increase (that's called inflation) while the domestic economy is slowing (that's called stagflation).

One commodity in particular is likely to go up in price for the U.S. is oil. OPEC is not only feeling the pressure of excess inventory, but they are losing value in petro-dollars. Look to gasoline's increase since the election to continue.

In the meantime and despite Bernake's protestations otherwise, the bond market is betting that the economy is slowing more than expected and that interest rates will be going down soon.

0 Comments:

About Me

- Name: Greyhair

- Location: Wine Country, California

I'm a very lucky person with every allergy known to man but still happy to be enjoying a wonderful life living in the best place in the world!

Blogroll

The Big PictureBillmon

Blah3.com

Born at the Crest of Empire

Eric Alterman

Eschaton

FireDogLake

Feingold's Blog

Dan Froomkin

The Huffington Post

Hullabaloo

The Illustrated Daily Scribble

Jesus General

Juan Cole

Matilda's Advice and Rants

Mia Culpa

MsJan Quilts

Needlenose

The Oil Drum

Political Animal

Political Wire

Spooks of the Ozarks

Talk About Corruption

TalkLeft

Think Progress

War and Peace

The Washington Note