Bending the Third Rail

Because We Should, We Can, We Do

Cost of the War in Iraq

(JavaScript Error)

Monday, September 25, 2006

Commodity Bubble

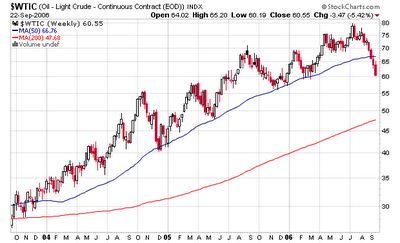

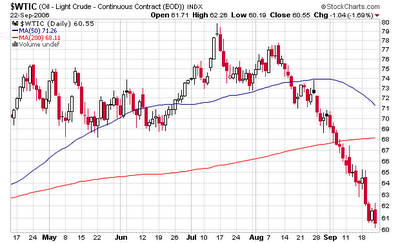

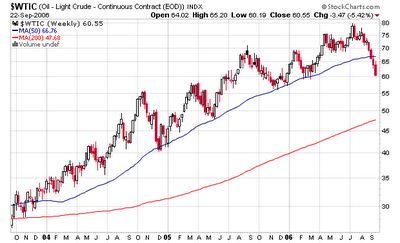

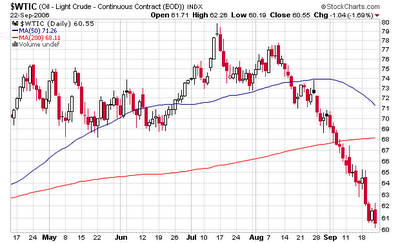

Take a look at this chart for oil prices over the past three years (click to enlarge, hat tip to Barry Ritholtz):

Even more dramatic is the weekly chart:

My my. That's quite a correction going on. Why is this happening?

There is quite a bit of speculation going on, but very little in terms of actual facts to make a case. Some say it's market manipulation ahead of the midterms. I'm not too sure about that as that would require a pretty concerted effort by a lot of greedy people to cause such an action.

Other explanations include that it portends a world economy that is dramatically slowing and the oil markets are predicting a severe recession, that the "hurricane premium" is being removed, that the "terraist premium" is being reduced, that money is rolling out of oil (and commodities in general) and moving into tech stocks, that it's the end of the summer driving season, and on and on and on.

Personally, I think there's a bit of truth in all the explanations. I also think that because it's such a speculative bubble based on emotion, any world events (such as an attack on Iran?) would cause prices to re-escalate to new highs .... quickly. And along the lines of my adaptation theory, note that major support for prices is around $58 / barrel, significantly higher than just a few years ago. I don't think there's any doubt that despite these short term factors, the bull trend in oil will continue until technological changes in energy take hold.

Even more dramatic is the weekly chart:

My my. That's quite a correction going on. Why is this happening?

There is quite a bit of speculation going on, but very little in terms of actual facts to make a case. Some say it's market manipulation ahead of the midterms. I'm not too sure about that as that would require a pretty concerted effort by a lot of greedy people to cause such an action.

Other explanations include that it portends a world economy that is dramatically slowing and the oil markets are predicting a severe recession, that the "hurricane premium" is being removed, that the "terraist premium" is being reduced, that money is rolling out of oil (and commodities in general) and moving into tech stocks, that it's the end of the summer driving season, and on and on and on.

Personally, I think there's a bit of truth in all the explanations. I also think that because it's such a speculative bubble based on emotion, any world events (such as an attack on Iran?) would cause prices to re-escalate to new highs .... quickly. And along the lines of my adaptation theory, note that major support for prices is around $58 / barrel, significantly higher than just a few years ago. I don't think there's any doubt that despite these short term factors, the bull trend in oil will continue until technological changes in energy take hold.

2 Comments:

About Me

- Name: Greyhair

- Location: Wine Country, California

I'm a very lucky person with every allergy known to man but still happy to be enjoying a wonderful life living in the best place in the world!

Blogroll

The Big PictureBillmon

Blah3.com

Born at the Crest of Empire

Eric Alterman

Eschaton

FireDogLake

Feingold's Blog

Dan Froomkin

The Huffington Post

Hullabaloo

The Illustrated Daily Scribble

Jesus General

Juan Cole

Matilda's Advice and Rants

Mia Culpa

MsJan Quilts

Needlenose

The Oil Drum

Political Animal

Political Wire

Spooks of the Ozarks

Talk About Corruption

TalkLeft

Think Progress

War and Peace

The Washington Note

Thanks, also, for the fine blogging you do on the stock market and economy.