Bending the Third Rail

Because We Should, We Can, We Do

Cost of the War in Iraq

(JavaScript Error)

Tuesday, June 13, 2006

Secularity

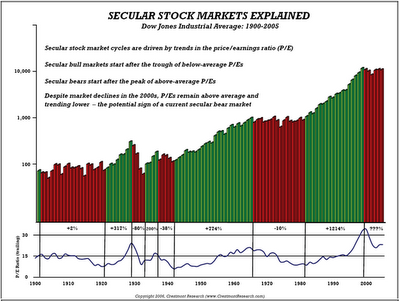

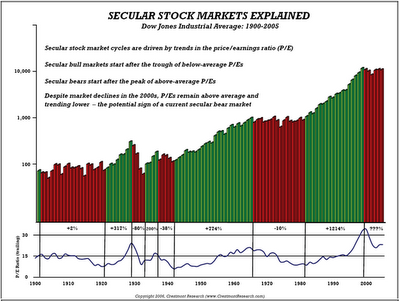

For any of you interested in the stock market, here's another great chart showing the relationship between "secular" (long term) market trends and P/E (stock price-earnings ratios):

Bottom line, we're likely in a bear market right now with a brief (a couple of years) bull cycle.

On another note, the other big news today is the release of the core producers price index. It was up more than expected. This is yet another indicator, even within the lousy government measurements, that inflation is cooking right along. Conservatives claim it's because we have such a swell economy. I claim it's because we have an artificially high set of energy prices caused by Bush and peak oil.

I'm also (finally) starting to see the term "stagflation" in news stories.

Really?

(click to enlarge)

Bottom line, we're likely in a bear market right now with a brief (a couple of years) bull cycle.

On another note, the other big news today is the release of the core producers price index. It was up more than expected. This is yet another indicator, even within the lousy government measurements, that inflation is cooking right along. Conservatives claim it's because we have such a swell economy. I claim it's because we have an artificially high set of energy prices caused by Bush and peak oil.

I'm also (finally) starting to see the term "stagflation" in news stories.

Really?

0 Comments:

About Me

- Name: Greyhair

- Location: Wine Country, California

I'm a very lucky person with every allergy known to man but still happy to be enjoying a wonderful life living in the best place in the world!

Blogroll

The Big PictureBillmon

Blah3.com

Born at the Crest of Empire

Eric Alterman

Eschaton

FireDogLake

Feingold's Blog

Dan Froomkin

The Huffington Post

Hullabaloo

The Illustrated Daily Scribble

Jesus General

Juan Cole

Matilda's Advice and Rants

Mia Culpa

MsJan Quilts

Needlenose

The Oil Drum

Political Animal

Political Wire

Spooks of the Ozarks

Talk About Corruption

TalkLeft

Think Progress

War and Peace

The Washington Note