Bending the Third Rail

Because We Should, We Can, We Do

Cost of the War in Iraq

(JavaScript Error)

Sunday, June 11, 2006

Chart of the Week

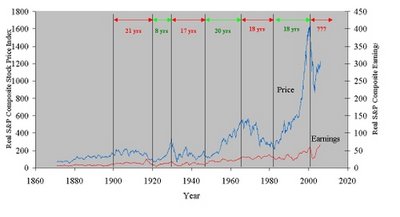

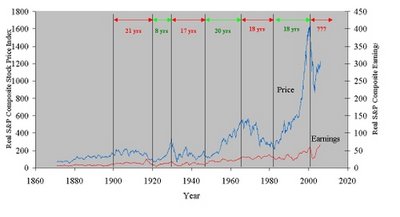

Here's a handy dandy historical chart, adjusted for inflation, of the stock market (S&P 500) from The Big Picture (click to enlarge):

The red periods are stretches of "bear" markets and the green are stretches of "bull" markets.

The red periods are stretches of "bear" markets and the green are stretches of "bull" markets.

Why put this up you say?

To illustrate how the conventional "buy and hold" strategy of most financial advisors is stupid. Suppose you did your investing for retirement starting in, oh, say 1965. So the early 90's roll around and you want to retire. How have those stock investments done?

This chart also starkly shows just how inflated, by historical standards, stock prices really are. From what I read, I'm guessing we're in a brief (3-5 yr. cyclical bull market) market upswing that is a part of a longer term (5-20 yr secular bear market) market downturn that began in 2001. If so, this is a very poor time to remain invested in the stock market on a "buy and hold" basis. You can clearly identify the "cycles" that occur within a larger market trend. This is what is meant by "cyclical" vs. "secular".

Of course, I'm not a market professional. But I'm suggesting that if you are investing in the stock market, take the time to learn about the dynamics involved. Don't just rely on a brokerage house representative who has a big vested interest in perpetuating the "buy and hold" strategy.

The red periods are stretches of "bear" markets and the green are stretches of "bull" markets.

The red periods are stretches of "bear" markets and the green are stretches of "bull" markets.Why put this up you say?

To illustrate how the conventional "buy and hold" strategy of most financial advisors is stupid. Suppose you did your investing for retirement starting in, oh, say 1965. So the early 90's roll around and you want to retire. How have those stock investments done?

This chart also starkly shows just how inflated, by historical standards, stock prices really are. From what I read, I'm guessing we're in a brief (3-5 yr. cyclical bull market) market upswing that is a part of a longer term (5-20 yr secular bear market) market downturn that began in 2001. If so, this is a very poor time to remain invested in the stock market on a "buy and hold" basis. You can clearly identify the "cycles" that occur within a larger market trend. This is what is meant by "cyclical" vs. "secular".

Of course, I'm not a market professional. But I'm suggesting that if you are investing in the stock market, take the time to learn about the dynamics involved. Don't just rely on a brokerage house representative who has a big vested interest in perpetuating the "buy and hold" strategy.

1 Comments:

About Me

- Name: Greyhair

- Location: Wine Country, California

I'm a very lucky person with every allergy known to man but still happy to be enjoying a wonderful life living in the best place in the world!

Blogroll

The Big PictureBillmon

Blah3.com

Born at the Crest of Empire

Eric Alterman

Eschaton

FireDogLake

Feingold's Blog

Dan Froomkin

The Huffington Post

Hullabaloo

The Illustrated Daily Scribble

Jesus General

Juan Cole

Matilda's Advice and Rants

Mia Culpa

MsJan Quilts

Needlenose

The Oil Drum

Political Animal

Political Wire

Spooks of the Ozarks

Talk About Corruption

TalkLeft

Think Progress

War and Peace

The Washington Note

Even if I had money to invest, I wouldn't. I was paying attention to the lessons that Ken Lay, Jeff Skilling, Bernie Ebbers, Dennis Koslowski, etc. taught.