Bending the Third Rail

Because We Should, We Can, We Do

Cost of the War in Iraq

(JavaScript Error)

Friday, April 14, 2006

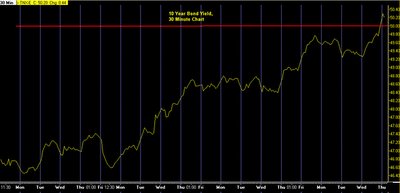

Yielding UPDATE

Anyone notice that bond yields are going up .... a lot?

Given that most of our debt is purchased by foreign governments, this is significant. Suppose you're the head of the Chinese government, and you looked at what's going on in the U.S. right now, including our foreign policy. Would you be buying U.S. debt? And if foreign governments stop buying, what happens to yields?

That's right, through the roof baby.

And then what you ask. Higher rates = a slowing economy, slowing growth. But energy prices keep rising you say. Yep, inflation continues despite slowing. This is called stagflation. Hopefully it won't look like the 1970's stagflation.

UPDATE: I've been reading elsewhere that this rise in interest rates is due to the expectations of a heating economy.

I partially disagree.

In the last year or so, yields unexpectedly remained low while the economy improved. The "experts", including the FED, were wondering about this "conundrum" and attributing the depressed yields to an international "savings glut". In other words, the international community had lots and lots of cash (due to their exports to U.S.) and had to put it somewhere. The speculation was that the extra cash was put into Treasuries, causing a depression in yields.

All I'm doing is reversing that out. I suspect the international community is slowing investment in Treasuries due to U.S. financial instability (anyone notice the record deficit spending for March?) and due to international tensions, thus yields spike up. Although it's pretty unnecessary, click to enlarge this 10 yr. yield chart to see the depressed yields and then the spike.

Personally, I don't think the economy is "heating", but rather flat to slower. We now have the opposite "conundrum" of yields spiking despite tepid economic growth.

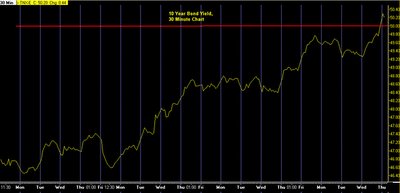

Given that most of our debt is purchased by foreign governments, this is significant. Suppose you're the head of the Chinese government, and you looked at what's going on in the U.S. right now, including our foreign policy. Would you be buying U.S. debt? And if foreign governments stop buying, what happens to yields?

That's right, through the roof baby.

And then what you ask. Higher rates = a slowing economy, slowing growth. But energy prices keep rising you say. Yep, inflation continues despite slowing. This is called stagflation. Hopefully it won't look like the 1970's stagflation.

UPDATE: I've been reading elsewhere that this rise in interest rates is due to the expectations of a heating economy.

I partially disagree.

In the last year or so, yields unexpectedly remained low while the economy improved. The "experts", including the FED, were wondering about this "conundrum" and attributing the depressed yields to an international "savings glut". In other words, the international community had lots and lots of cash (due to their exports to U.S.) and had to put it somewhere. The speculation was that the extra cash was put into Treasuries, causing a depression in yields.

All I'm doing is reversing that out. I suspect the international community is slowing investment in Treasuries due to U.S. financial instability (anyone notice the record deficit spending for March?) and due to international tensions, thus yields spike up. Although it's pretty unnecessary, click to enlarge this 10 yr. yield chart to see the depressed yields and then the spike.

Personally, I don't think the economy is "heating", but rather flat to slower. We now have the opposite "conundrum" of yields spiking despite tepid economic growth.

0 Comments:

About Me

- Name: Greyhair

- Location: Wine Country, California

I'm a very lucky person with every allergy known to man but still happy to be enjoying a wonderful life living in the best place in the world!

Blogroll

The Big PictureBillmon

Blah3.com

Born at the Crest of Empire

Eric Alterman

Eschaton

FireDogLake

Feingold's Blog

Dan Froomkin

The Huffington Post

Hullabaloo

The Illustrated Daily Scribble

Jesus General

Juan Cole

Matilda's Advice and Rants

Mia Culpa

MsJan Quilts

Needlenose

The Oil Drum

Political Animal

Political Wire

Spooks of the Ozarks

Talk About Corruption

TalkLeft

Think Progress

War and Peace

The Washington Note