Bending the Third Rail

Because We Should, We Can, We Do

Cost of the War in Iraq

(JavaScript Error)

Friday, March 17, 2006

March CPI/Stock Market

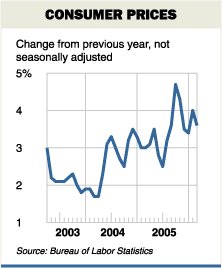

As most of you know, I'm fairly pessimistic about the economy in the long term. I think we're headed for a period of "stagflation". Yestereday's consumer price index came in quite tepid:

This is good news. But I also think it's short term good news. With another round of energy price increses inevitable, I can't believe the uptrend won't be supported by future reports to the upside.

Here's hoping I'm wrong!

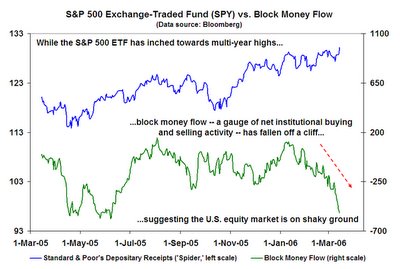

On another front, there's this via Barry at the Big Picture:

What this chart says is that while the S&P is charging ahead in the market, institutional money is drying up. If this continues, it's not a good sign for small investors. It's my experience the big guys run up the market, generating a lot of buzz. Then they stop buying, letting the small guys continue to the upswing. This is a "topping" process in the market. The next step will be for the large institutional money flows to start leaving the market (if that hasn't happened already), letting the little guys get stuck without a chair in the stock market "musical chairs".

If you're heavily invested in the stock market, watch out!

This is good news. But I also think it's short term good news. With another round of energy price increses inevitable, I can't believe the uptrend won't be supported by future reports to the upside.

Here's hoping I'm wrong!

On another front, there's this via Barry at the Big Picture:

What this chart says is that while the S&P is charging ahead in the market, institutional money is drying up. If this continues, it's not a good sign for small investors. It's my experience the big guys run up the market, generating a lot of buzz. Then they stop buying, letting the small guys continue to the upswing. This is a "topping" process in the market. The next step will be for the large institutional money flows to start leaving the market (if that hasn't happened already), letting the little guys get stuck without a chair in the stock market "musical chairs".

If you're heavily invested in the stock market, watch out!

0 Comments:

About Me

- Name: Greyhair

- Location: Wine Country, California

I'm a very lucky person with every allergy known to man but still happy to be enjoying a wonderful life living in the best place in the world!

Blogroll

The Big PictureBillmon

Blah3.com

Born at the Crest of Empire

Eric Alterman

Eschaton

FireDogLake

Feingold's Blog

Dan Froomkin

The Huffington Post

Hullabaloo

The Illustrated Daily Scribble

Jesus General

Juan Cole

Matilda's Advice and Rants

Mia Culpa

MsJan Quilts

Needlenose

The Oil Drum

Political Animal

Political Wire

Spooks of the Ozarks

Talk About Corruption

TalkLeft

Think Progress

War and Peace

The Washington Note