Bending the Third Rail

Because We Should, We Can, We Do

Cost of the War in Iraq

(JavaScript Error)

Friday, November 17, 2006

Ouch

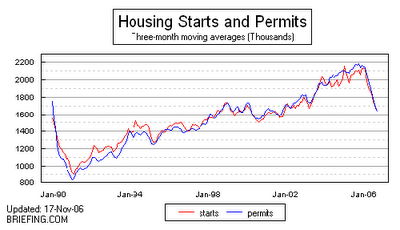

If you're in the "housing" industry, you're still searching for the floor:

Barry Ritholtz:

Barry Ritholtz:

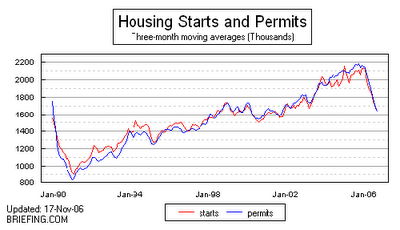

Here's a little historical perspective on housing starts:

Yaaaoooowzers

H/T The Big Picture for graphs.

Barry Ritholtz:

Barry Ritholtz:The October 06 Housing Starts were the weakest since July 2000, with Starts down 27% from the same period a year ago.The magnitude of what's happening is astounding. Remember, interest rates are still under 6%. We've had times when interest rates were much much higher. Obviously the speculative bubble has popped with liquidity moving into the stock market. Wonder how long until that begins to deflate? If the housing problem spills into consumer spending, watch out for that landing Mr. Economy!

At present, the Housing situation will exert a much greater drag on Q4 GDP -- even more of a drag than the negative 1.1% of Q3.

Bloomberg quoted Phillip Neuhart, an economist at Wachovia, who said: "This is a shocking number. The market is going to remain weak well into next year.''

Here's a little historical perspective on housing starts:

Yaaaoooowzers

H/T The Big Picture for graphs.

0 Comments:

About Me

- Name: Greyhair

- Location: Wine Country, California

I'm a very lucky person with every allergy known to man but still happy to be enjoying a wonderful life living in the best place in the world!

Blogroll

The Big PictureBillmon

Blah3.com

Born at the Crest of Empire

Eric Alterman

Eschaton

FireDogLake

Feingold's Blog

Dan Froomkin

The Huffington Post

Hullabaloo

The Illustrated Daily Scribble

Jesus General

Juan Cole

Matilda's Advice and Rants

Mia Culpa

MsJan Quilts

Needlenose

The Oil Drum

Political Animal

Political Wire

Spooks of the Ozarks

Talk About Corruption

TalkLeft

Think Progress

War and Peace

The Washington Note